Portugal Wage Simulator

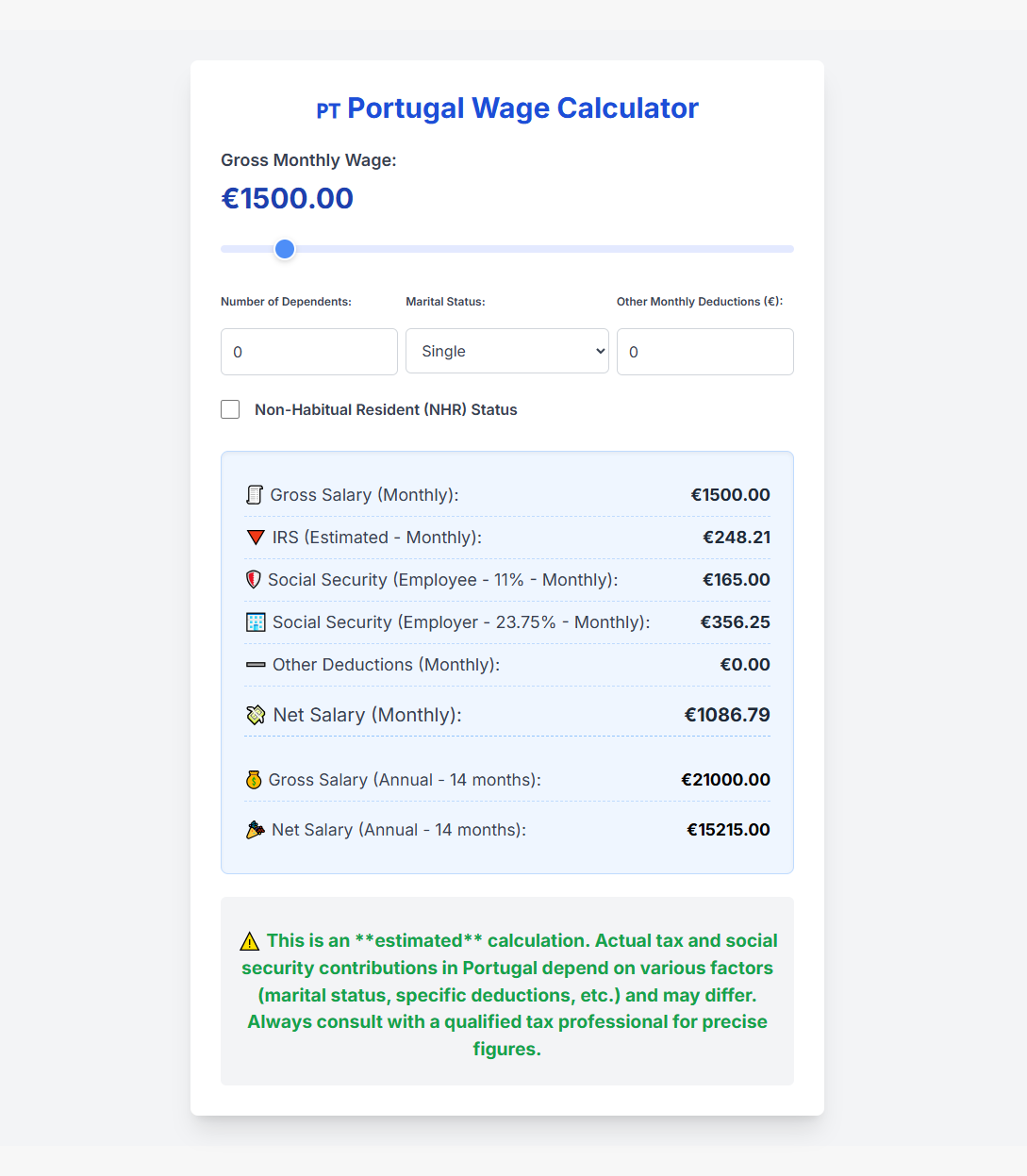

Curious about how much you'll actually earn in Portugal after taxes and social security? I’ve built a simple and effective Wage Simulator to help workers and expats get a clear picture of their net income under different scenarios.

| Preview | Download |

If you're working or planning to work in Portugal, understanding your net salary after taxes and social security deductions is essential. Whether you're a local resident or an expat relocating to Portugal, this free wage simulator gives you an instant, reliable estimate of your take-home pay — all directly in your browser.

This tool is particularly useful for:

- Professionals moving to Portugal

- Remote workers based in Portugal

- Employers estimating payroll costs

- Job seekers comparing gross offers with actual income

This lightweight, browser-based tool lets you simulate your monthly and annual net salary, taking into account:

- Gross wage

- Marital status

- Number of dependents (children)

- Non-Habitual Resident (NHR) tax regime

- Custom deductions

What is the Portugal Wage Simulator?

The Portugal Wage Simulator is a lightweight, interactive tool built using Vue.js (via CDN) that runs entirely in the browser — no installs, no logins, no tracking.

With just a few clicks, you can simulate:

- Gross monthly salary (with a dynamic slider)

- Marital status and household type

- Number of dependents (children)

- Special regimes like the Non-Habitual Resident (NHR) tax benefit

- Additional monthly deductions (e.g. union dues, meal cards)

The simulator then calculates:

- IRS tax (imposto sobre o rendimento de pessoas singulares) based on simplified 2024 brackets

- Employee Social Security contributions (11%)

- Employer Social Security costs (23.75%)

- Net monthly and annual income (considering 14 payments/year)

This allows users to better understand their expected net income in Portugal, especially useful for relocation planning, salary negotiations, and financial decisions.

You can move a slider to set your gross monthly income and instantly see how income tax (IRS), social security, and other deductions affect your take-home pay.

What’s Behind the Calculator?

The app is built using Vue 3 + CDN — meaning it’s fast, requires no installation, and works even offline. Here’s a breakdown of the main logic inside the JavaScript <script> block that powers the calculations:

const wage = ref(1500);

This stores your gross monthly wage, reactive to the slider input.

const dependents = ref(0);

const maritalStatus = ref('single');

const isNhr = ref(false);

const otherDeductions = ref(0);

These variables represent user-selected options:

- Marital status (single, married_one_income, married_two_incomes)

- Number of children/dependents

- Whether the user qualifies for NHR (Non-Habitual Resident tax regime)

- Any custom deductions (e.g. union dues, meal cards)

IRS Tax Calculation:

const irs = computed(() => { ... });

This block simulates Portugal’s IRS tax system, using simplified monthly brackets based on annual tax bands:

- If the user is under the NHR regime, a flat 20% tax is applied.

- Otherwise, a progressive tax rate is applied, with deductions:

- Married individuals receive a discount.

- Children reduce IRS by €50 per dependent (illustrative).

Note: This doesn't replace Finanças official calculations — it's educational and directional.

const ssEmployee = computed(() => salary * 0.11);

const ssEmployer = computed(() => salary * 0.2375);

These apply Portuguese standard rates:

Employees: 11%

Employers: 23.75%

Net and Annual Salary

const net = computed(() => salary - irs - ssEmployee - otherDeductions);

const annualNet = computed(() => net * 14);

In Portugal, salaries are commonly paid in 14 months per year (12 + Christmas + vacation pay), so both monthly and annual net salary are calculated.

Try It Yourself

- It's open-source

- You can use it offline

- You can fork it and customize it

If you're a freelancer, remote worker, expat, or just planning your budget — this is a great way to understand what your paycheck really looks like in Portugal.

Tech Stack

- Vue 3 (via CDN)

- Tailwind CSS for styling

- 100% HTML + JavaScript – no build tools required

Disclaimer: This is an estimated calculation. Actual tax and social security contributions in Portugal depend on various personal and legal factors (marital status, deductions, tax residence, etc.) and may differ from the results shown. Always consult with a certified accountant or tax advisor for precise and up-to-date figures.